United States

Securities and Exchange Commission

Washington, D. C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No.__)

Filed by the Registrant (x)☒

Filed by a Party other than the Registrant ( )☐

Check the appropriate box:

( )☐ Preliminary Proxy Statement

( )☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

(x)☒ Definitive Proxy Statement

( )☐ Definitive Additional Materials

( )☐ Soliciting Material Under Rule 14a-12

SYNALLOY CORPORATIONASCENT INDUSTRIES CO.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

(x)☒ No fee required

( ) $125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(1), or 14a6(i)(2) or Item 22a(2) of Schedule 14A

( )☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| |

1. | Title of each class of securities to which transaction applies: _____ |

| |

2. | Aggregate number of securities to which transaction applies: _____ |

| |

3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

4. | Proposed maximum aggregate value of transaction: _____ |

( )1. Title of each class of securities to which transaction applies: _____

2. Aggregate number of securities to which transaction applies: _____

3. Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

4. Proposed maximum aggregate value of transaction: _____

5. Total fee paid:

☐ Fee paid previously with preliminary materials.

( )☐ Check box if any part of the fee is offset as provided inby Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| | | | |

| Amount Previously Paid: | _____ |

| Form Schedule or Registration Statement No.: | _____ |

| Filing Party: | _____ |

| Date Filed: | _____ |

SYNALLOY CORPORATION

4510 COX ROAD, SUITE 201

RICHMOND, VA 23060ASCENT INDUSTRIES CO.

1400 16th Street, Suite 270

NOTICE OF ANNUAL MEETINGOak Brook, Illinois 60523

May 5, 2016

TO THE SHAREHOLDERS OF SYNALLOY CORPORATIONMay 1, 2023

Dear Fellow Stockholder:

You are cordially invited to virtually attend our Annual Meeting of Stockholders (including any adjournments or postponements thereof, the “Annual Meeting”) on June 13, 2023, which will be held in a virtual meeting format only via live audio webcast. Included with this letter are the notice of annual meeting of stockholders, a proxy statement detailing the business to be conducted at the Annual Meeting, and a proxy card. You may also find electronic copies of these documents online at www.proxyvote.com.

Regardless of whether you plan to attend our virtual Annual Meeting, it is important that your voice be heard. We encourage you to vote in advance of the meeting by telephone, by Internet or by signing, dating and returning your proxy card by mail. You may also vote by attending the virtual annual meeting at www.virtualshareholdermeeting.com/ACNT2023 and voting online. Full instructions are contained in the proxy statement and in the enclosed proxy card.

Sincerely,

ASCENT INDUSTRIES CO.

1400 16th Street, Suite 270

Oak Brook, Illinois 60523

Notice is hereby given that theof 2023 Annual Meeting of Shareholders

The 2023 Annual Meeting of Shareholders (2023 Annual Meeting) of Synalloy Corporation, a Delaware corporation (the "Company"),Ascent Industries Co. (Company) will be helda virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/ACNT2023 on Monday, June 13, 2023, at 9:00 a.m. Eastern Time. To access this website and enter the meeting, you must have your control number available.

Matters to be voted on at the Richmond Marriott Short Pump, Innsbrook Room, 4240 Dominion Boulevard, Richmond, VA 23060,2023 Annual Meeting are as follows:

1.Election of the five director nominees named in this Proxy Statement.

2.Approval, on a non-binding advisory basis, of the compensation of our named executive officers (say-on-pay).

3.Consideration of other business properly presented at 10:00 a.m. local time on Thursday, May 5, 2016. The following important matters will be presented for your consideration.the meeting.

|

| |

1. | Election of eight nominees listed in the Proxy Statement to the Company's Board of Directors to hold office until the 2017 Annual Meeting of Shareholders or until their successors are elected and qualified; |

2. | Approval, on a non-binding advisory basis, of the compensation of our named executive officers (say on pay); |

3. | Ratification of the Audit Committee's selection of KPMG, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; and |

4. | Transaction of such other business as may properly be brought before the meeting and any adjournment or adjournments thereof. |

All of the above matters are more fully described in the accompanying Proxy Statement.

Only

We are providing our proxy materials to our shareholders electronically again this year unless they previously requested to receive hard copies. Therefore, most of our shareholders will only receive a Notice of Internet Availability of Proxy Materials (Notice) containing instructions on how to access the proxy materials electronically and to vote. Electronic delivery allows the Company to provide you with the information you need for the 2023 Annual Meeting while reducing costs. Shareholders can request a paper copy of the proxy materials by following the instructions included on the Notice. Proxy materials will be made available to shareholders electronically on or around May 1, 2023 or mailed on or around the same date to those shareholders who have previously requested printed materials.

Record Date: You can attend the meeting online at www.virtualshareholdermeeting.com/ACNT2023 and vote if you were a shareholder of record at the close of business on March 7, 2016 areApril 17, 2023.

Proxy Voting: Each share of Ascent common stock is entitled to notice ofone vote on each matter properly brought before the meeting. Please vote by proxy as soon as possible. Your vote is very important to us, and we want your shares to votebe represented at the meeting.

Dated May 1, 2023

By order of the Board of Directors

Cheryl C. Carter

Doug Tackett, Corporate Secretary

April 8, 2016

Important: You are cordially invited to attend the meeting, but whether or not you plan to attend, PLEASE VOTE YOUR PROXY promptly by Internet, phone or mail as set forth on the proxy card. If you are a shareholder of record and attend the meeting, you may either use your proxy, or withdraw your proxy and vote in person.ASCENT INDUSTRIES CO.

The 2015 Annual Report on Form 10-K is furnished herewith.

SYNALLOY CORPORATION

20152023 Proxy Statement

Table of Contents

SYNALLOY CORPORATION

4510 COX ROAD, SUITE 201

RICHMOND, VA 23060ASCENT INDUSTRIES CO.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

May 5, 2016June 13, 2023

The 20152022 Annual Report to Shareholders, including our 20152022 Form 10-K, is being made available to shareholders together with these proxy materials on or about April 8, 2016.May 1 2023.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS, ANNUAL MEETING AND VOTING

When and where will the Annual Meeting be held?

The Annual Meeting of Shareholders of Synalloy CorporationAscent Industries Co. (the "Company") will be held as a virtual meeting and webcast live over the Internet. Please go to www.virtualshareholdermeeting.com/ACNT2023 for instructions on how to attend and participate in the Annual Meeting.Any shareholder may attend and listen live to the webcast of the Annual Meeting.Shareholders as of the record date may vote and submit questions while attending the Annual Meeting via the Internet by following the instructions listed on your proxy card. The webcast starts at the Richmond Marriott Short Pump, Innsbrook Room, 4240 Dominion Boulevard, Richmond, Virginia 23060, at 10:9:00 a.m. local timeET on Thursday, May 5, 2016. For directionsMonday, June 13, 2023. We encourage you to access the meeting prior to the meeting site, please go to http://investor.synalloy.com/events.cfm.start time.

Who is soliciting my proxy?

Our Board is soliciting your proxy to vote on all matters scheduled to come before the 20162023 Annual Meeting of Shareholders, whether or not you attend in person.the virtual meeting. By completing and returning the proxy card or voting instruction card, or by transmitting your voting instructions via the Internet, you are authorizing the proxy holders to vote your shares at our Annual Meeting as you have instructed.

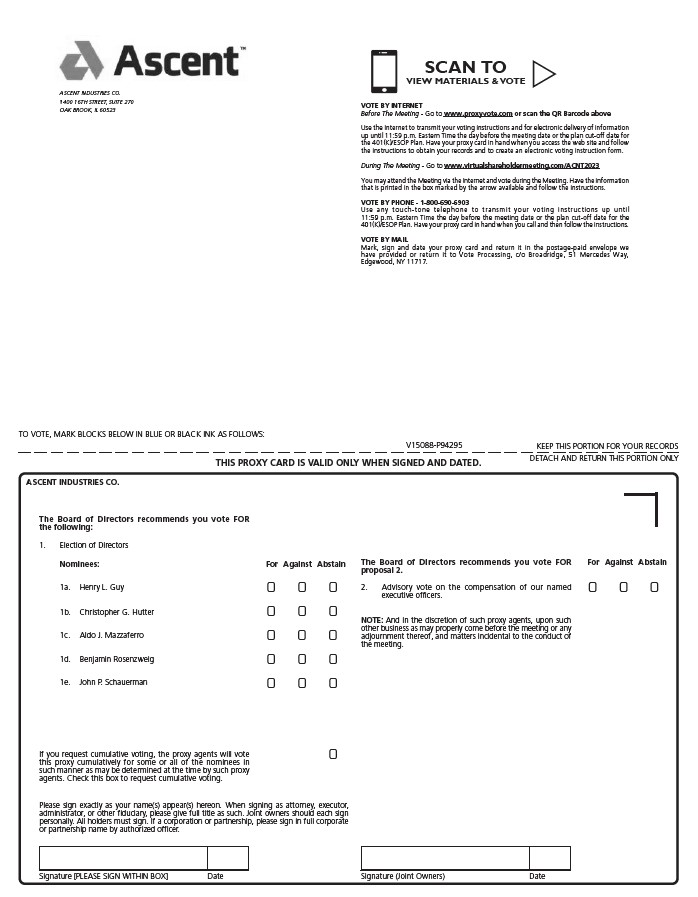

On what matters will I be voting? How does the Board recommend that I cast my vote?

At the Annual Meeting, you will be asked to: (1) elect the eightfive director nominees listed in this Proxy Statement; and (2) approve, on ana non-binding advisory basis, the compensation of our named executive officers; and ratify the appointment of our independent registered public accounting firm.officers.

Our Board unanimously recommends that you vote:

FOR all eightfive of the director nominees listed in this Proxy Statement; and

FOR the approval, on ana non-binding advisory basis, of the compensation of our named executive officers; and

FOR the ratification of the appointment of KPMG, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016.officers (say-on-pay).

How many votes may I cast?

You may cast one vote for every share of our Common Stock that you owned on March 7, 2016,April 17, 2023, the record date, except you have the right to cumulate your votes in regards tofor the election of directors. For more information, see "What is Cumulative Voting?cumulative voting?" below.

What is cumulative voting?

You have the right to cumulate your votes either (1)(i) by giving to one candidate as many votes as equal the number of shares owned by you multiplied by the number of directors to be elected, or (2)(ii) by distributing your votes on the same principle among any number of candidates.

How many shares are eligible to be voted?

On March 7, 2016,April 17, 2023, the record date, the Company had 8,641,87010,172,945 shares of Common Stock outstanding and eligible to be voted at the Annual Meeting (excluding 1,658,130912,838 shares held in treasury).

How many shares must be present to hold the Annual Meeting?

Under Delaware law and our Bylaws, the presence, in person (virtually) or by proxy, of the holders of a majority of the issued and outstanding shares of our Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. The inspector of election will determine whether a quorum is present. If you are a beneficial owner (as defined below) of shares of our Common Stock and you do not

instruct your bank, broker, or other holder of record how to vote your shares (so-called "broker non-votes"“broker non-votes”) on any of the proposals, your shares may stillwill not be counted as present at the Annual Meeting for purposes of determining whether a quorum exists since your bank, broker or other holder of record hasdoes not have discretionary authority to vote on Proposal 3.any of the proposals. In addition, shares held by shareholders of record who are present at the Annual Meeting in person or by proxy will be counted as present at the Annual Meeting for purposes of determining whether a quorum exists, whether or not such holder abstains from voting his shares on any of the proposals.

If a quorum is present at the Annual Meeting, with respect to Proposal 1 - "ElectionElection of Directors," directors will be elected by a pluralitymajority of the shares present and eligible to vote at the Annual Meeting. Abstentions and broker non-votes will have the effect of votes against the election of directors. As described in greater detail in the "Proposal 1 - Election of Directors" section of this Proxy Statement, our Board of Directors has adopted a director resignation policy that applies to the election of directors. Under this policy, any nominee who does not receive an affirmative vote of a majority of the votes cast by shares present in personis required to tender his or by proxy and entitledher resignation to vote at the meeting. "Plurality" means that, if there were more nominees than positions to be filled,Board of Directors. Consequently, the individuals who received the largest number of votes cast for directors would be elected, whether or not they receivedabstentions and broker non-votes with respect to a majority of votes cast. Votes that are withheld or shares that are not voted in the election of directorsnominee will have no effect on whether our director resignation policy will apply to that individual (but such abstentions and broker non-votes will have the outcomeeffect of votes against the election of directors.directors).

Approval for Proposal 2 - Advisory Vote on the Compensation of Our Named Executive Officers, and all other matters which may be considered and acted upon by the holders of Common Stock at the Annual Meeting will be approved if a majority of the shares present and eligible to vote at the meeting are voted in favor of the proposals. Abstentions and broker non-votes will have the effect of votes against these proposals.

If a quorum is not present or represented at the meeting, the chairman of the Annual Meeting has the power to adjourn the meeting. If the meeting is to be reconvened within 30 days, no notice of the reconvened meeting will be given other than an announcement at the adjourned meeting. If the meeting is to be adjourned for 30 days or more, or if a new record date is fixed for the adjourned meeting, notice of the reconvened meeting will be given as provided in the Bylaws.

Who pays for soliciting proxies?

We pay all expenses incurred in connection with the solicitation of proxies for the Annual Meeting. In addition to solicitations by mail, our directors, officers, and employees, without additional remuneration, may solicit proxies personally or by telephone, other electronic means or mail and we reserve the right to retain outside agencies for the purpose of soliciting proxies. Banks, brokers or other holders of record will be requested to forward proxy soliciting material to the beneficial owners, and as required by law, we will reimburse them for their related out-of-pocket expenses in this regard.expenses.

How do I vote?

Shareholders of Record

Shareholders of record can vote in person (virtually) at the Annual Meeting or by proxy. Shareholders of record may also vote their proxy by mail, by telephone or by Internet following the instructions on the proxy card.

Beneficial Shareholders

If your shares are held in the name of a bank, broker or other nominee, you will receive instructions from the nominee that you must follow in order for your shares to be voted. YourWithout your direction, your broker is not permitted to vote your shares on the election of directors or theadvisory vote on the compensation of our named executive officers unless you provide voting instructions, but does have discretionary authority to vote your shares on ratificationany of the appointment of KPMG, LLP.proposals. Therefore, if your shares are held in the name of a broker, to be sure your shares are voted, please instruct your broker as to how you wish it to vote.If your shares are not registered in your own name and you wish to vote your shares in person (virtually) at the Annual Meeting, you should contact your broker or agent to obtain a broker’s proxy card from your broker and bring it to the Annual Meeting in order to vote. You may vote your shares by Internet, by mail or by telephone as further described below.

Participants in the Synalloy CorporationAscent Industries Co. 401(k)/ESOP Plan

If you are a participant in the Synalloy CorporationAscent Industries Co. 401(k) Plan/Employee Stock Ownership Plan (the "401(k)/ESOP Plan")(401(k) Plan) and you own shares of our Common Stock through the 401(k)/ESOP Plan, the proxy card sent to you will also serve as your voting instruction card to the 401(k)/ESOP Plan trustee, who actually votes the shares of our Common Stock that you own through the 401(k)/ESOP Plan. Plan on your behalf. If you do not provide voting instructions for these shares to the trustee by 5:00 p.m., local time, April 28, 2016 ET, June 9, 2023 (the "planplan cut-off date")date), as directed by the terms of the 401(k)/ESOP Plan, the Company, in its capacity as the 401(k)/ESOP Plan administrator, will instruct the trustee to vote thoseyour 401(k)/ESOP Plan shares "FOR" all the director nominees named in this Proxy Statement and "FOR" all other proposals.

Voting Methods

You can vote your proxy by any of the methods below:

VOTE BY INTERNET - www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information until 11:59 p.m. Eastern TimeET the day before the meeting date, or the plan cut-off dateby 5:00 p.m. ET on June 9, 2023, for 401(k)/ESOP Plan participants. HavePlease have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred by our Company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions until 11:59 p.m. Eastern TimeET the day before the meeting date or the plan cut-off dateuntil 5:00 p.m. ET on June 9, 2023, for 401(k)/ESOP Plan participants. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

Only the latest dated proxy received from you, whether submitted by Internet, mail or telephone, will be voted at the Annual Meeting. If you vote by Internet or telephone, please do not mail your proxy card. You may also vote in person (virtually) at the Annual Meeting.

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

The rules of the Securities and Exchange Commission allow us to provide our proxy materials to our stockholders over the Internet if they have not requested that printed materials be provided to them on an ongoing basis. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials to our stockholders who have not previously requested that printed materials be provided to them on an ongoing basis. Instructions on how to access our proxy materials over the Internet or to request a printed copy by mail may be found in the Notice of Internet Availability of Proxy Materials. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

If you have previously elected to receive printed materials and would like to reduce the costs incurred by our Company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

What happens if I don’tdo not vote for a proposal? What is a broker non-vote?

If you properly execute and return a proxy or voting instruction card, your shares will be voted as you specify. If you are a shareholder of record and you return an executed proxy card but make no specifications on your proxy card, your shares will be voted in accordance with the recommendations of our Board, as provided above. If any other matters properly come before the Annual Meeting, the persons named as proxies by the Board of Directors will vote upon such matters according to their judgment.

If you hold your shares through a bank, broker or other nominee, and you return a broker voting instruction card but do not indicate how you want your broker to vote, your broker has discretionary authority to vote on Proposal 3, butthen a broker non-vote will occur as to Proposals 1 and 2. occur.A broker "non-vote"“non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee has not received instructions from the beneficial owner and either (i) does not have discretionary voting power for that particular proposal, or (ii) chooses not to vote the shares. Brokers do not have discretionary voting power to vote on Proposals 1, and 2.

Can I revoke or change my vote after I deliver my proxy?

Yes. You can revoke your proxy at any time before it is voted by providing notice in writing to our Corporate Secretary at 4510 Cox Road,1400 16th Street, Suite 201, Richmond, VA 23060;270, Oak Brook, Illinois 60523; by delivering a valid proxy bearing a later date to the Company’s officesoffice at 4510 Cox Road,1400 16th Street, Suite 201, Richmond, VA 23060,270, Oak Brook, Illinois 60523, prior to the meeting; or by attending the virtual meeting and voting in person. Attendance at the Annual Meeting will not in itself constitute revocation of a proxy. Shareholders who hold their shares in street name with a broker or other nominee may change or revoke their proxy instructions by submitting new voting instructions to the broker or other nominee.

I share an address with another shareholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

Some banks, brokers and other holders of record are "householding" our proxy statements and annual reports for their customers. This means that only one copy of our proxy materials may have been sent to multiple shareholders in your household. If you prefer to receive separate copies of a proxy statement or annual report, either now or in the future, please call us at 864-585-3605,804-822-3260, or send your request in writing to the following address: Corporate Secretary of Synalloy Corporation, 4510 Cox Road,Ascent Industries Co., 1400 16th Street, Suite 201, Richmond, VA 23060.270, Oak Brook, Illinois 60523. If you are still receiving multiple reports and proxy statements for shareholders who share an address and would prefer to receive a single copy of the annual report and proxy statement in the future, please contact us at the above address or telephone number. If you are a beneficial holder, you should contact your bank, broker or other holder of record.

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIAL FOR THE SHAREHOLDERS’ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 5, 2016JUNE 13, 2023

The Company’s 2015Company's 2022 Annual Report to Shareholders, 20152022 Annual Report on Form 10-K and 20162023 Proxy Statement are available via the Internet at http://investor.synalloy.com.investor.ascentco.com.

ANNUAL REPORT ON FORM 10-K

The Company’sCompany's 2022 Annual Report to Shareholders, including the Annual Report on Form 10-K for the fiscal year ended December 31, 20152022, as filed with the Securities and Exchange Commission ("SEC"), accompanies this Proxy Statement. Copies of exhibits to the 20152022 Annual Report on Form 10-K will be provided upon written request to the Corporate Secretary, Synalloy Corporation, 4510 Cox Road,Ascent Industries Co., 1400 16th Street, Suite 201, Richmond, VA 23060, at a charge270, Oak Brook, Illinois 60523, free of $.10 per page.charge. Copies of the 20152022 Annual Report on Form 10-K and exhibits may also be downloaded at no cost from the SEC’sSEC's website at http://www.sec.gov. The 20152022 Annual Report on Form 10-K does not form any part of the material for soliciting proxies.

BENEFICIAL OWNERS OF MORE THAN FIVE PERCENT (5%) OF THE COMPANY’S COMMON STOCK

The table below provides certain information regarding persons known by the Company to be the beneficial owners of more than five percent (5%) of the Company’s Common Stock as of December 31, 2015.2022. This information has been obtained from Forms 4, Schedules 13D, and 13G, and related amendments, filed with the SEC, and has not been independently verified by the Company.

| | | | | | | | | | | | | | |

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Total |

Privet Fund LP

79 West Paces Ferry Road, Suite 200B

Atlanta, GA 30305 | 1,846,643 | | (1) | 18.2% |

UPG Enterprises, LLC

1400 16th Street #250

Oak Brook, IL 60523 | 783,998 | | (2) | 7.7% |

Mink Brook Capital GP LLC

201 Summa Street

West Palm Beach, FL 33405 | 517,316 | | (3) | 5.1% |

(1) Based on the Schedule 13D/A filed with the SEC on December 23, 2021, Privet Fund LP has shared voting power with shared dispositive power with respect to 1,846,643 shares referenced above. |

(2) Based on the Schedule 13D/A filed with the SEC on July 2, 2020, UPG Enterprises, LLC has sole voting power with sole dispositive power with respect to 723,401 shares referenced above. |

(3) Based on the Schedule 13G filed with the SEC on April 6, 2023, Mink Brook Partners LP and Mink Brook Opportunity Fund LP held an aggregate of 517,316 shares of common stock. According to such Schedule 13G, as the general partner to both Mink Brook Partners LP and Mink Brook Opportunity Fund LP, Mink Brook Capital GP LLC may be deemed to have shared power to vote or to direct the vote and to dispose or to direct the disposition of the shares held by Mink Brook Partners LP and Mink Brook Opportunity Fund LP. In addition, such Schedule 13G states that as the managing member of Mink Brook Capital GP LLC, William Mueller may be deemed to have shared power to vote or to direct the vote and to dispose or to direct the disposition of the shares held by Mink Brook Partners LP and Mink Brook Opportunity Fund LP. Each of Mr. Mueller and Mink Brook Capital GP LLC have disclaimed beneficial ownership of shares of the Company’s common stock except to the extent of their respective pecuniary interests therein. It is unclear from the Schedule 13G filing whether Mink Brook Capital GP LLC was a stockholder as of December 31, 2022 or if its interest was acquired in 2023. |

|

| | | | | |

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

Markel Corporation 4521 Highwoods Parkway Glen Allen, VA 23060-3382 | 785,343 |

| | 9.09 |

Royce & Associates, LLC 745 Fifth Avenue New York, NY 10151 | 563,233 |

| (1) | 6.52 |

Van Den Berg Management, Inc. 805 Las Cimas Parkway, Suite 430 Austin, TX 78746 | 533,424 |

| (2) | 6.17 |

(1) Royce & Associates, LLC is an investment advisor registered with the SEC under the Investment Advisors Act of 1940. |

(2) Van Den Berg Management, Inc. is an investment advisor registered with the SEC under the Investment Advisors Act of 1940. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the ownership of the Company’s Common Stock as of March 7, 2016April 17, 2023, by each current director and nominee for director, each current executive officer of the Company for whom compensation information is disclosed under the heading "Discussion of Executive Compensation", and for the directors, nominees for director and executive officers of the Company as a group.

|

| | | | |

Name of Beneficial Owner | Common Stock Beneficially Owned | Percent of Class |

| Craig C. Bram | 210,571 |

| (1) | 3.36% |

| Murray H. Wright | 121,913 |

| (2) | 1.95% |

| James W. Terry, Jr. | 22,239 |

| (3) | * |

| J. Kyle Pennington | 26,954 |

| (4) | * |

| Dennis M. Loughran | 17,500 |

| | * |

| Richard D. Sieradzki | 16,891 |

| (5) | * |

| J. Greg Gibson | 12,000 |

| (6) | * |

| Henry L. Guy | 9,643 |

| (7) | * |

| Anthony A. Callander | 6,586 |

| | * |

| Amy J. Michtich | 6,345 |

| | * |

| Vincent W. White | 6,204 |

| (8) | * |

| Susan S. Gayner | — |

| | * |

| All Directors, Nominees and Executive Officers as a group (13 persons) | 496,761 |

| (9) | 7.93% |

| | | | | | | | | | | |

Name of Beneficial Owner | Common Stock Beneficially Owned | Percent of Total |

| Christopher G. Hutter | 999,166 | | (1) | 9.82% |

| John P. Schauerman | 78,742 | | | * |

| Benjamin Rosenzweig | 75,384 | | | * |

| Henry L. Guy | 71,486 | | (2) | * |

| Aldo J. Mazzaferro | 7,312 | | (3) | * |

| John R. Zuppo III | 4,460 | | | * |

| All Directors, Nominees and Executive Officers as a group (7 persons) | 1,236,550 | | | 12.16% |

| *Less than 1% |

(1) Includes 783,998 shares held by UPG Enterprises, LLC, of which Mr. Hutter has shared voting power and shared dispositive power. |

(2) Includes 606 shares held in custodial accounts for minor children; and 7,889 shares held in a revocable trust. |

(3) Includes 3,000 shares held in a self directed IRA |

|

|

*Less than 1% |

(1) Includes 2,548 shares held in an IRA; 28,763 shares held by his spouse; 3,150 shares allocated under the Company’s 401(k)/ESOP Plan; and 94,074 shares which are subject to currently exercisable options.

|

(2) Includes indirect ownership of 30,000 shares held by an IRA; 4,830 held by his spouse; 5,630 shares held in a custodial account for a minor child; and, 80,350 shares held in a revocable trust.

|

(3) Includes 16,000 shares held by an IRA.

|

(4) Includes 5,675 shares allocated under the Company’s 401(k)/ESOP Plan; and 5,891 shares which are subject to currently exercisable options.

|

(5) Includes 5,814 shares allocated under the Company’s 401(k)/ESOP Plan; and 5,084 shares which are subject to currently exercisable options.

|

(6) Includes 1,896 shares held in an IRA; 7,076 shares held under the Company's 401(k)/ESOP; and 1,778 shares which are subject to currently exercisable options.

|

(7) Includes 539 shares held in custodial accounts for minor children.

|

(8) Includes 6,204 shares held in a revocable trust.

|

(9) Includes 31,730shares allocated under the Company’s 401(k)/ESOP Plan; and 110,057 shares which are subject to currently exercisable options. The beneficial owners have a right to acquire such shares within 60 days of March 7, 2016.

|

PROPOSAL 1 - ELECTION OF DIRECTORS

The Certificate of Incorporation of the Company provides that the Board of Directors shall consist of not less than three nor more than 15 individuals. Upon recommendation of the Corporate Governance Committee and discussion by the current Board of Directors, the Board of Directors has fixed the number of directors constituting the full Board at eightfive members and recommends that the eightfive nominees listed in the table whichthat follows be elected as directors to serve for a term of one year until the next Annual Meeting or until their successors are elected and qualified to serve. Each of the nominees has consented to be named in this Proxy Statement and to serve as a director if elected.

If cumulative voting is not requested, the proxy agents named in the Board of Directors’ form of proxy that accompanies this Proxy Statement will vote the proxies received by them "FOR" the election of the eightfive persons named as directors. If cumulative voting is requested, the proxy agents named in the Board of Directors’ form of proxy that accompanies this Proxy Statement intend to vote the proxies received by them cumulatively for some or all of the nominees in such manner as may be determined at the time by such proxy agents.

If, at the time of the Annual Meeting of Shareholders, or any adjournment(s) thereof, one or more of the nominees is not available to serve by reason of any unforeseen contingency, the proxy agents intend to vote for such substitute nominee(s) as the Board of Directors recommends, or the Board of Directors will reduce the number of directors.

Vote Required

Directors will be elected by a pluralitymajority of the shares present and eligible to vote at the Annual Meeting. Abstentions and broker non-votes will have the effect of votes against the election of directors.

Director Resignation Policy: Our Bylaws provide that any nominee for director who duly holds office as a director under the Bylaws and does not receive an affirmative vote of a majority of the votes cast. Votes that are withheldcast shall promptly tender his or shares that areher resignation to the Board of Directors after such election. The Board of Directors will evaluate the relevant facts and circumstances and then determine whether to accept or reject the tendered resignation. Any director who tenders a resignation pursuant to this policy shall not votedparticipate in the Board of Directors’ decision. The Board of Directors will have no effect on the outcome of the election of directors.promptly disclose publicly its decision and decision-making process regarding a tendered resignation.

Board Recommendation

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE "FOR" THE ELECTION OF THE EIGHTFIVE NOMINEES LISTED IN THE FOLLOWING TABLE AS DIRECTORS OF THE COMPANY.

The following table sets forth the names of nominees for director, their ages, the years in which they were first elected or appointed directors, ifas applicable, and a brief description of their principal occupations and business experience during the last five years. There are no family relationships among any of the directors and executive officers. |

| | | | |

| Name, Age, Principal Occupation, Other Directorships and Other Information | Director

Since

|

Craig C. Bram, age 57

Mr. Bram became President, CEO and a director of Synalloy on January 24, 2011. From 2004 until September 24, 2010, he served as a director of the Company. He was the founder and has been President of Horizon Capital Management, Inc., an investment advisory firm located in Richmond, VA since 1995. Mr. Bram was the CEO of Bizport, Ltd., a document management company in Richmond, VA, from 2002 through 2010.

| 2004 |

Anthony A. Callander, age 69

Mr. Callander was appointed Upstate Managing Director by The Hobbs Group, a certified public accounting ("CPA") firm in Columbia, SC, effective January 2012. He retired from Ernst & Young, LLP in 2008 after 36 years in their Columbia, SC, Greenville, SC and Atlanta, GA offices. He served as a Partner in the firm's audit and assurance practice and in various other roles including Office Managing Partner of the Columbia and Greenville offices, and leading the Southeast manufacturing industry group. He serves on the Board of a non-charitable organization and is an active entrepreneur in various private enterprises.

| 2012 |

Susan S. GaynerHenry L. Guy, age 54

Ms. Gayner was named CEO and President of ParkLand Ventures, Inc., an owner-operator of multi-family housing communities in nine states, in May 2014. From October 2010, Ms. Gayner served as the COO of ParkLand, and was Vice President from May 2009. Ms. Gayner is a chemical engineer and holds an MAI designation (currently inactive). Prior to ParkLand, she served as an independent MAI and held various manufacturing and quality assurance roles with DuPont Company and Hercules, Inc.

| Nominee |

Henry L. Guy, age 47

Mr. Guy is the President & Chief Investment Officer for Pittco Management (Pittco), a single-family office located in Memphis, TN. Prior to Pittco, Mr. Guy served as President & CEO of Modern Holdings Incorporated, a diversified holding company with assets primarilylocated in the telecommunications and insurance industries. Mr. Guy joined the firm in 2002 and has led investments in over 30 Modern Holdings subsidiaries.Summit, NJ. Mr. Guy has served on the boardsboard of several public companies in the U.S. and Europe includingdirectors of Metro International S.A. and(MTRO), Scribona AB (CATB), Pergo AB (PERG), Miltope Corporation (MILT), and is currently on the board of Evermore Global Investments, a 40 Act regulated mutual fund.Advisors (EVGBX). Mr. Guy serves on the Board of Visitors for Vanderbilt University’s Owen Graduate School of Management. | 2011 |

Amy J. Michtich, age 47

Ms. Michtich currently serves as the Chief Supply Chain Officer of Molson Coors Canada, where she oversees end-to-end operational excellence for Canada's largest and North America's oldest brewer of quality beers and ciders. From 2007 to 2015, she was employed by MillerCoors, a joint venture formed in the U.S. by SABMiller and Molson Coors. During this time, Ms. Michtich served as Vice President - Brewery Operations, located in Rockingham County, VA and Brewery Operations Manager - Milwaukee, WI. Prior to 2007, Ms. Michtich held executive and operations leadership positions across various consumer package goods companies including Pepsi Bottling Group, Clorox and Lipton.

| 2014 |

James W. Terry, Jr., age 68

Mr. Terry has been the President of Hollingsworth Funds, Inc., Greenville, SC, a charitable foundation, since October 2009. His career has been principally in the banking industry where he served as President of Carolina First Bank, Greenville, SC from 1991 to 2008.

| 2011 |

Vincent W. White, age 58

Mr. White is engaged in real estate lending, investing and development activities and provides consulting services to publicly-held companies and institutional investors. In 2014 he retired from Devon Energy Corporation, a Fortune 500 oil and gas producer, after 21 years of service in various roles of increasing responsibility. Most recently, he served as Devon's Senior Vice President of Communications and Investor Relations. Mr. White is involved in various philanthropic endeavors and serves on the Boards of several non-profit organizations. He is a member of the National Investor Relations Institute's Senior RoundtableBoard of Visitors of the Owen Graduate School of Management at Vanderbilt University. He graduated from the United States Naval Academy with a Bachelor of Science degree in Economics and the American Institute of Certified Public Accountants.earned his MBA with a concentration in Operations and Strategy from Vanderbilt University.

| 20152011 |

Murray H. WrightChristopher G. Hutter, age 7043

Mr. Hutter became interim President & Chief Executive Officer (CEO) of Ascent on November 9, 2020 (the interim designation was removed on March 18, 2022). He also currently serves as Co-Founder and Manager of UPG Enterprises, LLC (f/k/a Union Partners, LLC), an operator of a diverse set of industrial companies focused on metals, manufacturing, distribution and logistics, since its founding in August 2014. At UPG Enterprises, Mr. Hutter oversees operations and growth initiatives at the holding company and portfolio company level, and has extensive experience in large scale acquisitions, transaction structuring and business operations and integration across a broad spectrum of industries. Mr. Hutter graduated cum laude from University of Illinois with a Bachelor of Science degree in Finance and earned his M.B.A.in Finance from Lewis University. | 2020 |

Benjamin Rosenzweig, age 38 Mr. Wright hasRosenzweig currently serves as a Partner at Privet Fund Management LLC, an investment firm focused on event-driven, value-oriented investments in small capitalization companies. Mr. Rosenzweig currently serves as a director of each of PFSweb, Inc. (NASDAQ: PFSW), a global commerce service provider (since May 2013), and Hardinge Inc. (formerly NASDAQ: HDNG), a global designer, manufacturer and distributor of machine tools (since October 2015). Mr. Rosenzweig also served as Chairmana Director of Bed Bath & Beyond (NASDAQ:BBBY), a retailer, during 2022, Potbelly Corporation (NASDAQ: PBPB), a restaurant chain, from 2018 through 2022, Cicero, Inc. (OTC:CICN), a desktop automation company, from 2017 until 2020, Startek, Inc. (NYSE: SRT), a business process outsourcing provider, from 2011 through 2018, and RELM Wireless Corporation (now knows as BK Technologies Corp. (NYSE MKT: BKTI), a manufacturer of land mobile radio equipment, from 2013 through 2015. Mr. Rosenzweig graduated magna cum laude from Emory University with a Bachelor of Business Administration degree in Finance and a second major in Economics. | 2020 |

John P. Schauerman, age 66 Mr. Schauerman has been a Director of Primoris Services Corporation (“Primoris”) (NASDAQ: PRIM) since November 15, 2016. He previously served in numerous executive roles at Primoris, including Executive Vice President of Corporate Development, Chief Financial Officer. Mr. Schauerman previously served on the Board of Synalloy since 2014.Directors of MYR Group (NASDAQ: MYRG); Harmony Merger Corp. (NASDAQ: HRMNU): Allegro Merger Corp (NASDAQ: ALGR); and Wedbush Securities, Inc. Mr. Schauerman is a member of the Dean’s Executive Board of the UCLA School of Engineering. Mr. Schauerman holds an M.B.A. in Finance from Columbia University, New York, and a B.S. in Electrical Engineering from the University of California, Los Angeles. | 2020 |

Aldo J. Mazzaferro, age 69 Aldo Mazzaferro is an equity research analyst with over 35 years’ experience covering the global steel and metals sectors at several large Wall Street investment banking firms. He became employedretired as Managing Director and Senior Analyst at Macquarie Capital (USA) in 2017. Since then and currently, Mr. Mazzaferro operates a research and consulting practice and is a partner in a real estate investment firm. Mr. Mazzaferro held significant senior research positions on Wall Street, including Vice President at Goldman Sachs for 8 years (2000-2008), where he led a globally recognized steel research franchise, and as Senior CounselAnalyst at Deutsche Bank for 12 years (1987-1998). He moved to the Richmond, VA law firm of DurretteCrump, PLCsteel industry in January 2013. From 2011 until January 2013, he was a Partner at the VanDeventer Black LLP law firm, Richmond, VA, where he served as Senior Counsel from 20092008 to 2011. From 1999 to 2012, he was a founder and managing director of Avitas Capital,join Steel Development Co. LLC, a closely held investment banking firm in Richmond, VA.start-up company planning to build and operate a series of new, high-technology steel micro-mills. He was Chief Financial Officer there from 2008 to 2011, when he left and ultimately joined Macquarie. Mr. Mazzaferro graduated with a B.A. from Holy Cross College and earned his M.B.A. from Northeastern. | 20012022 |

The Corporate Governance Committee believes the combined business and professional experience of the Company’s directors, and their various areas of expertise make them a useful resource to management and qualify them for service on the Board. Messrs. Wright and Bram have served on the Board for a significant period of time. During their tenures, these directors have gained considerable institutional knowledge about the Company and its operations, which has made them effective board members. Because the Company’s operations are complex, continuity of service and development of institutional knowledge help make the

Board more efficient and more effective at developing long-range plans than it would be if there were frequent turnover in Board membership. When a Board member decides not to run for re-election, the Corporate Governance Committee seeks replacement directors who it believes will make significant contributions to the Board for a variety of reasons, including among others, business and financial experience and expertise, business and government contacts, relationship skills, knowledge of the Company and diversity.

The Corporate Governance Committee believes the current Board members and nominee are highly qualified to serve and each member has unique qualifications and business expertise that benefit the Company. Mr. Wright’s career as a trial lawyer, founder and CEO of a law firm and his business and financial experience as managing director of a closely-held investment banking firm are considered to be valuable attributes to the Board. Mr. Bram has over 30 years’ experience in business management, financial operations, logistics, management consulting, business start-ups and strategic planning for a variety of companies. Mr. Bram was employed by the Reynolds Metals Company, a global aluminum manufacturer, in its corporate Logistics and Sales and Marketing departments. He is an investor in multiple private businesses and real estate ventures and also serves on the boards of several private companies. Mr. Terry joined the Board in August 2011. He brings a wealth of experience in the banking industry where he spent more than 35 years including 17 years as President of a bank where he managed and directed an 85-branch statewide network growing the asset structure from approximately $300 million in 1991 to over $6 billion in 2008. In his current role at Hollingsworth Funds, Mr. Terry manages and administers a non-profit fund exceeding $100 million and is responsible for investment asset management, expense and accounting functionality for all subsidiary operations with assets exceeding $400 million. We believe Mr. Terry’s banking experience is valuable in helping the Company evaluate financing options as well as acquisitions. A Board member since August 2011,

•Mr. Guy’s primary career focus has been in the area of private investments. His expertise and experience in this area are valuable tools as the Company focuses on growing through acquisitions.

•Mr. Callander spent his career in the auditHutter is a demonstrated business builder and assurance practiceorganizational leader with significantoperational know how and management capabilities across industrial segments, particularly steel and metals. His diverse experience in auditing,covers areas that include corporate strategy, operations management, mergers and acquisitions, initiallogistics and warehousing and supply chain optimization.

•Mr. Rosenzweig has corporate governance expertise based on service on numerous public offerings and other financings, reorganizations, business process improvementprivate company boards of directors, including multiple manufacturing companies. He has a background leading and business strategyworking on mergers and acquisitions, restructurings and refinancing situations, and strategic board-level reviews.

•Mr. Schauerman has operational, financial, corporate development. From 1998 to 2003, while with Ernst & Young, and strategic planning expertise gained from executive roles and directorships at construction and infrastructure companies. He has corporate governance experience as a result of service on several private and public company boards of directors across business-to-business sectors.

•Mr. Callander served as the audit partner on the Company’s independent audits, giving him in depth experience and knowledge about the Company. Mr. Callander, a CPA, also meets the criteria of a financial expert. Amy Michtich joined the Board in 2014 and has served in executive and operations leadership positions with several large union and non-union manufacturing businesses. She has significantMazzaferro’s extensive experience in the areas of human resources, manufacturing operations, environmentalsteel and safety. Mr. White brings expertise in the oil and gas industry, and with Synalloy’s increased presence in the energy markets, the Corporate Governance Committee was particularly interested in adding expertise to support this effort. He has experience in the areas of mergers and acquisitions, and public and media relations. Mr. White is also a CPA. Ms. Gayner, a first-time director nominee, offers valuable experience in the chemical business. She has 10 years' experience working for two large chemical companies in the area of quality assurance and as ametals research and development engineer. In herinvestment banking industries will provide valuable insight into the steels and metals industries as well as current role as CEOcapital markets and President of Parkland Ventures, Inc., she has valuable experience in executive management and operations.trends.

BOARD OF DIRECTORS AND COMMITTEES

The Board of Directors currently has five members: Henry L. Guy, Christopher G. Hutter, Benjamin Rosenzweig, John P. Schauerman, and Aldo J. Mazzaferro.

Director Independence.

The Board of Directors has determined that for 2022 each of the following directors and director nominee iswere independent as such term is defined by the applicable rules of the NASDAQNasdaq Stock Market LLC (the "NASDAQ Rules"“Nasdaq Rules”): Anthony Callander, Susan Gayner, Henry L. Guy, Amy Michtich, James Terry, Vincent WhiteAldo J. Mazzaferro and Murray Wright.John P. Schauerman. The Board has also determined that each of the current members of the Audit Committee, the Compensation & Long-Term Incentive Committee and the Corporate Governance Committee isduring 2022 were independent within the meaning of the NASDAQNasdaq Rules.Effective as of March 18, 2022, Aldo Mazzaferro was appointed to the Board and Mr. Rosenzweig was appointed as the Executive Chairman of the Board.Following his appointment as Executive Chairman, it was determined that Mr. Rosenzweig was no longer independent within the meaning of the Nasdaq Rules and that for 2022 Mr. Mazzaferro replaced Mr. Rosenzweig as an independent director on each person who served on such committees at any time during 2015 was independent underof the NASDAQ Rules.Audit Committee, the Compensation & Long-Term Incentive Committee and the Corporate Governance Committee.

Board and Board Committee Meetings and Attendance at Shareholder Meetings.

During fiscal year 2015,2022, the Board of Directors met sixfour times. All members of the Board except Ms. Michtich attended 75% or more of the aggregate of the total number of meetings of the Board of Directors and of the committees of the Board on which they served. The Company encourages, but does not require, its directors to attend annual meetings of shareholders. AllTo the best of our knowledge, all directors attended the 20152022 Annual Meeting. The Company has standing Audit, Compensation & Long-Term Incentive and Corporate Governance Committees of the Board of Directors.Meeting, which was held virtually.

The Board has established an Audit Committee, a Compensation & Long-Term Incentive Committee, and a Corporate Governance Committee, each of which is comprised entirely of directors who meet the applicable independence requirementrequirements of the NASDAQ rules.Rules. The Committeescommittees keep the Board informed of their actions and provide assistance toassist the Board in fulfilling its oversight responsibility to shareholders. The table below provides current membership information as of December 31, 2022, as well as the meeting information for the last fiscal year.

| | | | | | | | | | | |

| Name | Audit Committee | Compensation & Long-Term Incentive Committee | Corporate Governance Committee |

| Henry L. Guy | X | X(1) | X |

| Christopher G. Hutter | | | |

| Benjamin Rosenzweig | | | |

| John P. Schauerman | X(1) | X | X |

| Aldo J. Mazzaferro | X | X | X(1) |

| Total Meetings Held in 2022 | 4 | 2 | 2 |

(1) Committee Chair |

(2) Effective as of March 18, 2022, Aldo Mazzaferro was appointed to the Board and Mr. Rosenzweig was appointed as the Executive Chairman of the Board. Following his appointment as Executive Chairman, Mr. Rosenzweig was no longer independent within the meaning of the Nasdaq Rules and Mr. Mazzaferro replaced Mr. Rosenzweig as an independent director on each of the Audit Committee, the Compensation & Long-Term Incentive Committee and the Corporate Governance Committee. |

|

| | | |

| Name | Audit Committee | Compensation & Long-Term Incentive Committee | Corporate Governance Committee |

| Anthony A. Callander | X* | | X |

| Henry L. Guy | X | X* | |

| Amy J. Michtich | | X | X |

| James W. Terry | X | X | X* |

| Vincent W. White | X | | X |

| Total Meetings in 2015 | 8 | 7 | 4 |

| * Committee Chair |

Audit Committee.

The Company has an Audit Committee is established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934.

The Audit Committee1934 and acts pursuant to a written charter adopted by the Board of Directors, which is available on the Company’s website at www.synalloy.com.www.ascentco.com. Each member of the Audit Committee is independent as defined in the NASDAQ Rules and meets the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934. The Audit Committee selects and appoints the independent registered public accounting firm,auditor, pre-approves fees paid to the independent auditor, reviews and discusses with management and the independent auditorsauditor prior to filing with the SEC the audited financial statements to be included in the Company’s Annual Report on Form 10-K and the unaudited financial statements included in the Form 10-Q for each quarter, meets independently with the independent auditors,auditor, reviews the Audit Committee’s charter, and has oversight of the Company’s Code of Conduct and Internal Audit.

Aldo J. Mazzaferro, Henry L. Guy and John P. Schauerman served on the Audit Committee as of December 31, 2022. The Board designated Mr. CallanderSchauerman as the Audit Committee Financial Expert, as defined by the Securities and Exchange Commission ("SEC")SEC rules.

Compensation & Long-Term Incentive Committee.

All members of the Compensation & Long-Term Incentive Committee are independent directors as defined in the NASDAQ Rules.Rules, and none of them is a present or past employee or officer of the Company or its subsidiaries. This committeeCommittee acts pursuant to a written charter which is available on the Company’s website at www.synalloy.com.www.ascentco.com. The committeeCommittee reviews and approvedapproves salaries, bonuses, incentive compensation and benefits for the Company’s executive officers, of the Company, and administers and makes recommendations with respect to the Company’s cash incentive and equity plans, including the granting of shares and options thereunder, and reviews the committee’s charter.

The committeeCommittee sets the compensation for the CEO. ItCEO and evaluates performance and considers recommendations from the Company’s CEO in setting compensation for other senior executive officers. The Director of Human Resources supports the committee in its duties, and the committee may delegate authority to the Human Resources Department to fulfill administrative duties relating to the Company’s compensation programs. The committee has the authority under its charter to retain and terminate,engage and approve fees for compensation consultants and other advisors as it deems appropriate to assist it in the fulfillment of its duties. In earlySince 2016, the Committee has retained Pearl Meyer (“PM”) as the Executive Compensation Committee’s outsideits independent compensation consulting firm. PM is a nationally recognized executive compensation consultant and the CompensationThe Committee has retained itreviewed and confirmed the independence of Pearl Meyer. Neither Pearl Meyer nor any of its affiliates provide any services to assist in designing the 2016Company except for services related solely to executive compensation plans including information concerning compensation paid by competitorsofficer and members of our peer group. No member ofdirector compensation

Aldo J. Mazzaferro, Henry L. Guy and John P. Schauerman served on the Compensation & Long-Term Incentive Committee or the managementas of the Company is, or has been, affiliated with PM.December 31, 2022.

Corporate Governance Committee.Committee

All members of the Corporate Governance Committee (formerly the Nominating/Corporate Governance Committee) are independent as defined in the NASDAQ Rules. This committeeCommittee acts pursuant to a written charter which is available on the Company’s website at www.synalloy.com.www.ascentco.com. This committeeCommittee is responsible for reviewing and recommending changes in the size and composition of the Board of Directors and evaluating and recommending candidates for election to the Company’s Board. This committeeThe Committee also reviews and oversees corporate governance issues and makes recommendations to the Board related to the adoption of policies pursuant to rules of the SEC, NASDAQ and other governing authorities, and as required by the Sarbanes-Oxley Act of 2002.

Compensation Committee InterlocksAldo J. Mazzaferro, Henry L. Guy and Insider Participation. Henry Guy, Amy Michtich and James TerryJohn P. Schauerman served on the Compensation & Long-Term IncentiveCorporate Governance Committee during 2015. All membersas of the Compensation & Long-Term Incentive Committee are independent directors and none of them is a present or past employee or officer of the Company or its subsidiaries.December 31, 2022.

9

Related Party Transactions.

The Company requires that each executive officer, director and director nominee complete an annual questionnaire and report all transactions with the Company in which such persons (or their immediate family members) had or will have a direct or indirect material interest (except for salaries, directors’ fees and dividends on our stock). Management reviews responses to the questionnaires and, if any such transactions are disclosed, they are reviewed by the Board of Directors. The Company does not, however, have a formal written policy setting out these procedures. There were no such transactions duringSee “Related Party Transactions” below.

Retirement Policy

The Board of Directors has adopted a retirement policy with respect to the fiscal year ended December 31, 2015.Company's directors. Under the policy, directors who attain the age of 75 prior to an annual meeting of the Company's shareholders are not eligible to be nominated for re-election to the Company's Board of Directors at the annual meeting.

CORPORATE GOVERNANCE

Board Leadership Structure and Board’s Role in Risk Oversight

The Board of Directors'Directors’ roles and responsibilities are set forth in the Bylaws and Board Charter which provide for a Chairman elected by the Board from among its members, and our Bylaws further provide that two or more offices may be held by the same person.members. The business and affairs of the Company are managed under the direction of the Board of Directors, and that management control is subject to the authority of the Board of Directors to appoint and remove any of our officers at any time. Our Board does not have a specific policy as to whether the role of Chairman and CEO should be held by separate persons, but rather makes an assessment ofassesses the appropriate form of leadership structure on a case-by-case basis. The Board believes that this issue can beplays a part ofin the succession planning process and recognizes that there are various circumstances that weigh in favor of or against both combination and separation of these offices. Since 2002, the roles of Chairman and CEO have been held by separate persons. The Board believes it is appropriate, and in our Company’s best interests, for the two roles to continue to be separated.separated at this time.

Board’s Role in Risk Oversight

Our Board is actively involved in the oversight of risks that could affect our Company. The Board receives regular reports from members of senior management on areas of material risk to us, including strategic, operational, financial, information technology (including cyber risk), legal and regulatory and strategic risks. These reports are reviewed by the full Board, or, where responsibility for a particular area of risk oversight is delegated to a committee of the Board, that committee reviews the report and then reports to the full Board. TheIn addition, the Audit Committee’s charter requires the committee to inquire of management and the registered public accountantsindependent auditor about significant risks or exposures and assess the steps management has taken to manage such risks, and further requires the committee to discuss with the registered public accountantsindependent auditor the Company’s policies and procedures to assess, monitor, and manage business risk, and legal and ethical compliance programs (e.g., the Company’s Code of Conduct).programs.

Director Qualifications and Nomination Process

The Corporate Governance Committee has adopted Corporate Governance Guidelines that setsset forth factors in recommending and evaluating candidates, including personal characteristics, core competencies, commitment and independence, among other factors in recommending and evaluating candidates.independence. It also takes into consideration such factors as it deems appropriate based on the Company’s current needs. These factors may include diversity, age, skills such as understanding of appropriate technologies and general finance, decision-making ability, inter-personal skills, experience with businesses and other organizations of comparable size, and the interrelationship between the candidate’s experience and business background, and other Board members’ experience and business background. Although the Corporate Governance Committee does not have a specific policy with regard to the consideration of diversity in identifying director nominees, the committee considers racial and gender diversity, as well as diversity in business and educational experience, among all of the directors, as part of the total mix of information it takes into account in identifyingapplied to identify nominees. Additionally, candidates for director shouldmust possess the highest personal and professional ethics and they should be committed to the long-term interests of the shareholders.shareholders of the Company.

The Corporate Governance Committee does not have any specific process for identifying director candidates. Such candidates are routinely identified through personal and business relationships and contacts of the directors and executive officers. The Board Charter does require that any director nominee, whether a new nominee or a previous director, must be less than 75 years of age on the date of the Annual Meeting of Shareholders and Board of Director nominee vote.

The Corporate Governance Committee will consider as potential Board of Directors’ nominees persons recommended by shareholders if the following requirements are met. If a shareholder wishes to recommend a director candidate to the Corporate Governance Committee for consideration as a Board of Directors’ nominee, the shareholder must submit in writing to the Corporate Governance Committee the recommended candidate’s name, a brief resume setting forth the recommended candidate’s business and educational background and qualifications for service, the number of the Company’s shares beneficially owned by the person, and a notarized consent signed by the recommended candidate stating the recommended candidate’s willingness to be nominated and to serve. Additionally, the recommending shareholder must provide his or her name and address and the number of the Company’s shares beneficially owned by such person. This information must be delivered to the Corporate Secretary of the Company at the Company’s corporate headquarters at 4510 Cox Road,1400 16th Street, Suite 201, Richmond, VA 23060 for270, Oak Brook, Illinois 60523 or transmission to the Corporate Governance Committee and must be received not less than 90 days nor more than 120 days prior to an annual meetingthe Annual Meeting of shareholders. The committee may request further information if it determines a potential candidate may be an appropriate nominee. Director candidates recommended by shareholders that comply with these requirements will receive the same consideration from the committee that the committee’sother candidates receive.

Nominations for election as directors may also be made by shareholders from the floor at an annual meetingthe Annual Meeting of shareholdersShareholders provided such nominations arewere received by the Company not less than 3060 nor more than 6090 days prior tobefore the anniversary of the preceding year's annual meeting of shareholders, contain the information set forth above, and otherwise are made in accordance with the procedures set forth in the Company’s Bylaws.

Shareholder Communications with Directors

Any shareholder who wishes to send communications to the Board of Directors should mail them addressed to the intended recipient by name or position in care of: Corporate Secretary, Synalloy Corporation, 4510 Cox Road,Ascent Industries Co., 1400 16th Street, Suite 201, Richmond, VA 23060.270, Oak Brook, Illinois 60523. Upon receipt of any such communications, the Corporate Secretary will determine the identity of the intended recipient and whether the communication is an appropriate shareholder communication. The Corporate Secretary will send all appropriate shareholder communications to the intended recipient. An "appropriate“appropriate shareholder communication"communication” is a communication from a person claiming to be a shareholder in the communication the subject of which relates solely to the sender’s interest as a shareholder and not to any other personal or business interest.

In the case of communications addressed to the Board of Directors, the Corporate Secretary will send appropriate shareholder communications to the Executive Chairman of the Board. In the case of communications addressed to the independent or outside directors, the Corporate Secretary will send appropriate shareholder communications to the Chairman of the Audit Committee. In the case of communications addressed to committees of the Board, the Corporate Secretary will send appropriate shareholder communications to the Chairman of such committee.

DIRECTOR COMPENSATION

Compensation of Non-Employee Directors

For the 2015-162022-2023 term year, non-employee directors were paid an annual retainer of $50,000, and each director was permitted to elect to receive up to 100% of the annual retainer in restricted stock. The number of restricted shares issued is determined by the average of the high and low Common Stock price on the day prior to the Annual Meeting of Shareholders or the date prior to the appointment to the Board. For 2015, non-employee directors elected by the shareholders for the 2015-16 term year received an aggregate of 8,216 shares of restricted stock in lieu of such cash retainer amount as follows: Anthony Callander - 1,730; Henry Guy - 1,989; Amy J. Michtich - 3,459; and James Terry - 1,038. For the 2015-16 term year, Directors were compensated $1,750 for each board meeting attended in person; $1,250 for each telephone board meeting; and $1,250 for attendance at committee meetings not held on board meeting days. The Chairman of the Board, and the Chairs of the Audit Committee and the Compensation & Long-Term Incentive Committee received additional annual compensation of $7,500 each. Directors were reimbursed for travel and other expenses related to attendance at meetings.

After reviewing directors’ compensation of a number of public companies, the Board elected to change the pay structure of directors’ fees to an annual flat retainer, in part to ease the administrative burden of keeping up with meeting fees, and also to permit more frequent board and committee meetings, as needed, without incurring additional cost. The Board also compared average annual directors’ compensation of companies in our primary peer group and found it to be significantly higher than the average annual compensation of our directors. For the 2016-17 term year, non-employee directors will be paid a total annual retainer of $95,000 to be paid$102,000 in the form of cash and restricted stock. Directors must elect a minimum of $25,000$30,000 of the retainer fee to be paid in restricted stock and may elect up to 100% of the retainer to be paid in restricted stock.The number of restricted shares issued was determined by the average of the high and low Common Stock price on the day prior to the 2022 Annual Meeting of Shareholders or, if later, the date prior to the director’s appointment to the Board.

The annual retainer is inclusive of all director fees andfees; directors willdid not receive meeting fees or chair fees in addition to the retainer.retainer, except that Mr. Rosenzweig received certain additional equity grants described in the table below relating to extraordinary services performed in his capacity as director. Directors arewere reimbursed for travel and other expenses related to attendance at meetings. Directors who are employees do not receive extra compensationFor the 2023-2024 term year, the total annual retainer for service onnon-employee directors will be increased to $115,000 in the Board or any committeeform of the Board.cash and restricted stock.

The shares granted to the non-employee directors are not registered under the Securities Act of 1933 and are subject to forfeiture in whole or in part upon the occurrence of certain events.

The following table sets forth information about compensation paid by the Company to non-employee directors during fiscal 2015.calendar year 2022.

| | | | | | | | | | | |

| Name | Fees Paid in Cash (1) | Stock Awards (2)(3) | Total |

| (a) | (b) | (c) | (d) |

| Henry L. Guy | $51,500 | $51,000 | $102,500 |

| Aldo J. Mazzaferro | $36,318 | $52,000 | $88,318 |

| Benjamin Rosenzweig | $0 | $1,186,850 | $1,186,850 |

| John P. Schauerman | $30,500 | $70,000 | $100,500 |

(1) Represents fees paid in cash during 2022. |

(2) Represents the grant date fair value, computed in accordance with FASB ASC Topic 718 as disclosed in the Stock Awards footnote to the Summary Compensation Table, of restricted shares granted to the directors for 2022 service. For 2022, the directors received restricted shares in lieu of cash retainer as follows: Henry L. Guy - 3,056; Aldo Mazzaferro - 3,116; Benjamin Rosenzweig - 6,111; and John P. Schauerman - 4,194. No director has been granted any stock options by the Company. |

(3) Includes an aggregate of 65,000 additional shares of restricted stock to Benjamin Rosenzweig for his services as Executive Chairman of the Board. The award consists of 15,000 restricted stock units and 50,000 performance stock units. The restricted stock units will vest 50% on the first and second anniversary of the award while the performance stock units vest upon the achievement of specific thirty-day volume weighted average price targets of the Company's common stock. |

|

| | | |

| Name | | Fees Earned or Paid in Cash ($) (1) | Total ($) |

| (a) | | (b) | (h) |

| Anthony A. Callander | | 77,375 | 77,375 |

| Henry L. Guy | | 85,500 | 85,500 |

| Amy J. Michtich | | 60,750 | 60,750 |

| James W. Terry, Jr. | | 77,000 | 77,000 |

| Vincent W. White | | 52,750 | 52,750 |

| Murray H. Wright | | 64,625 | 64,625 |

(1) As discussed above, each non-employee director was permitted to elect to receive up to 100% of the annual retainer in stock pro rata to his or her service on the Board. For the 2015-16 term year, directors received an aggregate of 8,216 shares of restricted stock in lieu of such cash retainer amount as follows: Anthony Callander - 1,730; Henry Guy - 1,989; Amy Michtich - 3,459; and James Terry - 1,038. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers, and any persons who own more than 10% of the Common Stock of the Company, to file with the SEC reports of beneficial ownership and changes in beneficial ownership of Common Stock. Officers and directors are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on review of the copies of such reports furnished to the Company or written representations that no other reports were required, the Company believes that, during 2015, all filing requirements applicable to its officers and directors were met on a timely basis.

Codes of Conduct

Our Board has formally adopted a Code of Corporate Conduct that applies to all of our employees, officers and directors. Our Board formally adopted a separate Code of Ethics for our Chief Executive Officer ("CEO") and senior financial officers, which applies to our CEO, Chief Financial Officer ("CFO"), Chief Accounting Officer ("CAO"), Controller and all other senior financial and accounting executives. We intend to satisfy the disclosure requirement regarding any amendment to, or waiver of, a provision of the Code of Ethics for the Company’s CEO, CFO and Controller, or persons performing similar functions, by posting such information on the Company’s website.

There were no amendments to, or waivers of, any provision of the Code of Corporate Conduct or the Code of Ethics for the Company’s CEO, CFO, CAO, Controller, or any persons performing similar functions during fiscal year 2015. Copies of these codes are available on our website at www.synalloy.com.

EXECUTIVE OFFICERS

Information about Mr. Craig Bram, the Company’s CEO, is set forth above under "Election of Directors."

|

|

Name, Age, Principal Position and Five-Year Business Experience |

Dennis M. Loughran, age 58

Mr. Loughran joined the Company in July 2015, as SVP and CFO. Most recently, he was the CFO of Citadel Plastics, a privately-owned company headquartered in Chicago, IL, which merged with A Schulman, Inc. in June 2015. From 2006 to 2014, he served as the CFO for Rogers Corporation (NYSE:ROG), headquartered in Rogers, CT. Previous experience includes 19 years with Reynolds Metals Company in various financial and operations roles and six years as Vice President, Finance and Supply Chain with Alcoa Consumer Products. He has a broad background in international business management, financial reporting, planning and analysis, profit improvement, mergers and acquisitions, supply chain optimization, tax and treasury management and investor relations.

|

J. Kyle Pennington, age 58

Mr. Pennington was named President, Synalloy Metals, Inc., a subsidiary of the Company, effective January 1, 2013. He served as President, Bristol Metals, LLC, a subsidiary of the Company, from July 2011 until December 31, 2012. He was President, Bristol Metals, LLC’s BRISMET Pipe Division from September 2009 to July 2011; and Vice President, Manufacturing, Bristol Metals, LLC from December 2007 through September 2009. Prior to joining the Company, Mr. Pennington worked for 17 years in the metals industry including 12 years’ experience in executive management and service on the Board of Directors of Texas & Northern Industries, a Lone Star Steel Company subsidiary.

|

J. Greg Gibson, age 42

In April 2015, Mr. Gibson was named General Manager and President of Synalloy Chemicals, with business unit responsibility for both Manufacturers Chemicals and CRI Tolling. He served as Executive Vice President, Sales and Administration for Manufacturers Chemicals, a wholly-owned subsidiary from July 2011 to April 2015. Mr. Gibson joined the Company in 2005 as a sales representative providing expertise in building client relationships, growing product market share, sales profitability and developing and executing sales strategies. Prior to joining Synalloy Chemicals, he began his sales career in the pharmaceutical industry.

|

Richard D. Sieradzki, age 61

Mr. Sieradzki, a certified public accountant, was named CAO in July 2015. From 2010 to 2015, he served as CFO and Vice President, Finance. He also served as Assistant Vice President, Finance from 2007 to 2010. Prior to joining the Company, he was employed by Buffets, Inc. - Ryan’s Division as Divisional Vice President, Finance from 2006 to 2007 and from 1988 to 2006, he was Vice President, Accounting and Corporate Controller at Ryan’s Restaurant Group, Inc.

|

DISCUSSION OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis ("CD&A") describes our compensation program and policies, and explains how the Board’s Compensation & Long-Term Incentive Committee (the "Committee") established goals, reviewed performance measures, and decided compensation for our Named Executive Officers ("NEOs") in and for fiscal year 2015.

Section I: Compensation Philosophy, Objectives and Process

Compensation Philosophy and Objectives

The Board of Directors and Management believe that the performance and contributions of our executive officers are critical to our overall success. To attract, retain and motivate the executives to accomplish our business strategy, the Committee establishes executive compensation policies and oversees Company’s executive compensation practices.